Leading

Asset Tokenization

from the UAE

Where Real Assets meet Blockchain — UAE’s Tokenization Hub

AS SEEN IN MEDIA

THE FUTURE

FOR RWA TOKENIZATION

IS LIMITLESS

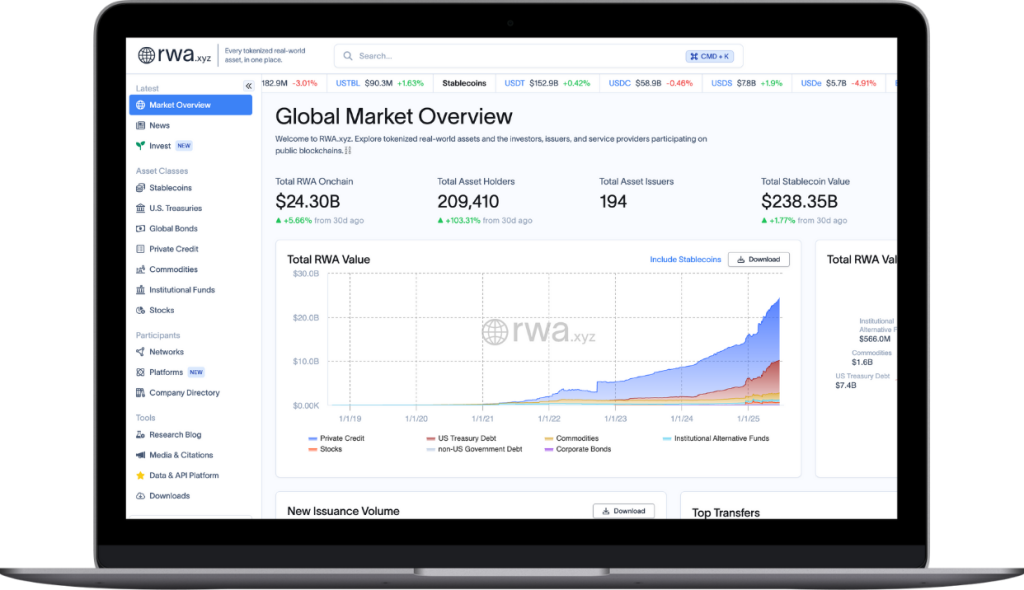

THE TOKENIZATION OF REAL-WORLD ASSETS (RWA) IS ACCELERATING, WITH OVER $24.30 BILLION IN VALUE LOCKED ON PUBLIC BLOCKCHAINS AS OF JUNE 2025 (SOURCE: RWA.XYZ).

To meet this rising demand, RWA Labs launches as a full-scope platform and infrastructure provider based in the UAE — helping founders, asset owners, and institutions bring real-world assets on-chain.

From company formation and legal structuring to business development, marketing, and ecosystem access, we offer everything needed to successfully tokenize and scale in one of the world’s most forward-looking regulatory environments.

WHAT CAN BE

TOKENIZED?

ESTATE

Fractional ownership in residential, commercial, and rental properties enables global investors to access high-yield real estate assets.

Tokenized debt instruments give investors access to private lending markets with enhanced transparency, liquidity, and real-time settlement.

GOOD

Iconic watches, handbags, cars, and collectibles can be fractionalized, authenticated, and traded globally with blockchain-based provenance.

Digitized gold enables stable, borderless access to precious metal investments with full custody, auditability, and 24/7 liquidity.

Oil, gas, metals, and agricultural assets become instantly tradable and accessible worldwide through tokenization and smart contracts.

Private equity and startup shares become tradable, improving investor access, unlocking liquidity, and enabling early-stage diversification.

Masterpieces and digital artworks can be fractionalized, verified on-chain, and traded globally with transparent provenance and ownership rights.

Verifiable carbon offsets become transparent, tradable assets - powering ESG strategies and enabling global climate-positive investing.

Music rights, patents, and creative royalties can be tokenized to provide upfront capital and automated revenue sharing.

Bridges, ports, and energy infrastructure can be fractionalized, creating new funding models and investor access to long-term yield.

Athlete earnings, sponsorships, and fan engagement tokens can be fractionalized and monetized through tokenized ownership structures.

Tokenized albums, films, and performance rights open up new financing and revenue opportunities across global fan and investor bases.

BENEFITS OF TOKENIZATION

IMPROVED TRANSPARENCY

AND SECURITY

Blockchain’s transparency and immutability enhance trust by recording every transaction, providing an auditable trail that reduces fraud.

LIQUIDITY

UNLOCKED

Provides a new way to raise capital by attracting a broader audience and allowing global investors to access diverse asset classes.

ACCESS TO

A WIDER INVESTOR BASE

Lowers the entry barrier, allowing smaller investors to participate in markets previously limited to wealthy individuals or institutions.

COST EFFICIENCY &

CONTINUOUS TRADING

Eliminates intermediaries for lower fees and faster settlements, and enables trading beyond traditional market hours.

PASSIVE INCOME THROUGH

YIELD

Whether through staking, lending or liquidity provision, holders can earn yield and put their tokens to work, maximizing capital efficiency in decentralized finance.

DISCUSS YOUR PROJECT WITH US

BOOK A CALL TO EXPLORE PRICING AND THE BEST-FIT PACKAGE FOR YOUR NEEDS

RWA LABS IS THE DECENTRALIZED HOME FOR REAL-WORLD ASSET REBELS, RULE-MAKERS, AND BUILDERS.

We’re not a think tank – we’re a do-tank of legal minds, blockchain devs, financiers, and operators with hands-on experience across every asset class. Whether you’re tokenizing your first asset or building full-scale infrastructure, RWA Labs delivers regulatory clarity, tech architecture, and capital strategy to take you from concept to launch.

Everyone’s welcome to join.

Core contributors shape the future of RWA Tokenization, and Members gain access to unprecedented networking, exclusive insights, and real opportunity to move markets.

OUR TEAM

APPLY TO JOIN US AS A CORE CONTRIBUTOR

BENEFITS WHY JOIN

WE OFFER OUR MEMBERS CUTTING-EDGE MARKET AND INDUSTRY ANALYSIS, THE LATEST TRENDS IN THE MARKETPLACE, EXCLUSIVE EVENTS, AND REGULATORY DEVELOPMENTS.

POLICY

ANALYSIS

Our team of experts provides timely analysis of current and proposed policies that may impact the interests of our members.

MARKET

ANALYSIS

Our members receive a frequent analysis of market trends, developments, and market risks which could offer both opportunities and threats.

INDUSTRY

ANALYSIS

Members-only research into ways that innovation is affecting transformation across and within industries on a local, national, and international scale.

NETWORKING

We provide regularly scheduled in-person and virtual networking offerings, helping directly connect members with industry leaders and stakeholders.

ADVOCACY

Regular engagement with key players in policy, technology, f inance, and risk management to advocate for our members and advance their interests.

EDUCATION

We provide cutting-edge training for our members. across broad spectrum of topics. This includes access to white papers, marketplace primers, and more.

OUR CLIENTS & PARTNERS

EXCHANGES

BANKS

MARKETING

TRANSFORM RWA INTO DIGITAL OPPORTUNITIES THROUGH

COMPLIANT, SCALABLE TOKENIZATION

UAE RWA TOKENIZATION

ECOSYSTEM MAP

EXPLORE THE KEY

RWA

TOKENIZATION COMPANIES

IN THE UAE

THE RWA ECOSYSTEM MAP SHOWCASES KEY UAE – BASED PLATFORMS, PROTOCOLS, CUSTODIANS, AND SERVICE PROVIDERS DRIVING SECURE, COMPLIANT, AND EFFICIENT TOKENIZED ASSET ADOPTION.

TOKENIZATION

STRUCTURING

EXPLORE THE PROCESS OF TOKENIZING REAL-WORLD ASSETS FROM STRUCTURING TO LAUNCH

Jurisdictional review, regulatory landscape, cost modeling, and timeline forecasting to ensure your tokenization project is viable and strategic.

Entity formation, legal contracts, shareholder agreements, token rights definition, and licensing pathways tailored to your asset class and region.

Designing token supply, vesting, pricing models, and incentive mechanisms to align investor returns with project sustainability and liquidity.

Selecting blockchain, custody, KYC/AML, compliance, and tokenization platforms that align with jurisdictional, technical, and business needs.

Custom smart contract development, testing, audits, and token deployment, ensuring regulatory alignment and upgradeable logic for future flexibility.

Setting up wallets, oracles, payment gateways, compliance modules, and technical integrations for seamless investor onboarding and token utility.

Go-to-market strategy, investor communications,, digital presence, market making and exchange listings to ensure token demand and visibility.

Structuring tax-efficient models, accounting systems, audit trails, and cross-border reporting compliance to protect stakeholders and maximize returns.

Token generation event, investor onboarding, governance rollout, regulatory filings, and early-stage performance tracking.

Ongoing legal, tax, and tech reviews, quarterly updates, governance improvements, and protocol or token upgrades based on performance.

TOKENIZATION STRUCTURING

EXPLORE THE PROCESS OF TOKENIZING REAL-WORLD ASSETS FROM STRUCTURING TO LAUNCH

POLICY & PUBLIC INITIATIVES

LOREM IPSUM HAS BEEN THE INDUSTRY’S STANDARD DUMMY TEXT EVER SINCE THE 1500S

1

LEGAL

REPORTS

LOREM IPSUM HAS BEEN THE INDUSTRY’S STANDARD DUMMY TEXT EVER SINCE THE 1500S

2

TECHNOLOGY

REPORTS

LOREM IPSUM HAS BEEN THE INDUSTRY’S STANDARD DUMMY TEXT EVER SINCE THE 1500S

3

ENGAGING WITH

REGULATORS

LOREM IPSUM HAS BEEN THE INDUSTRY’S STANDARD DUMMY TEXT EVER SINCE THE 1500S

4

BLAH

LOREM IPSUM HAS BEEN THE INDUSTRY’S STANDARD DUMMY TEXT EVER SINCE THE 1500S

DISCUSS YOUR PROJECT WITH US

BOOK A CALL TO EXPLORE PRICING AND THE BEST-FIT PACKAGE FOR YOUR NEEDS.

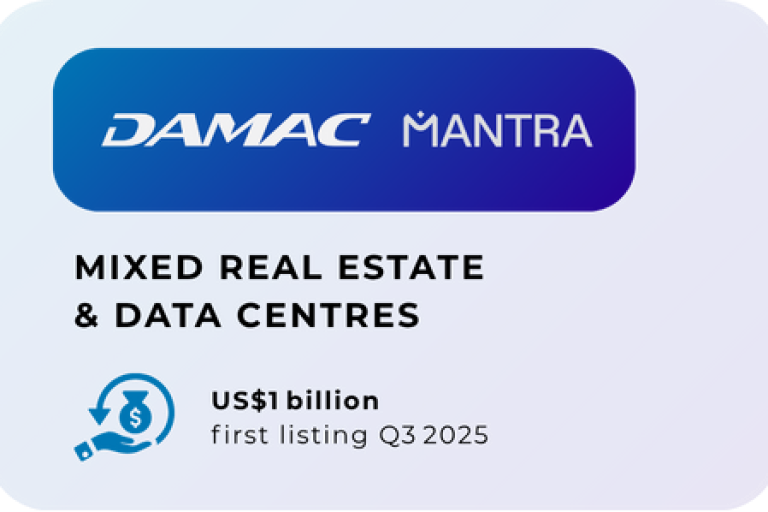

RWA TOKENIZATION IN THE UAE

SUCCESS STORIES OF REAL-WORLD ASSETS TOKENIZATION IN THE REGION

WHY UAE

FOR RWA TOKENIZATION?

CLEAR

REGUALTIONS

With VARA, ADGM, and SCA, the UAE offers regulatory clarity for tokenized assets.

INVESTOR-

FRIENDLY

A growing pool of institutional capital and crypto-savvy investors.

CRYPTO-READY

FREE ZONES

Business hubs like DMCC and ADGM support Web3 and tokenization ventures.

FLEXIBLE

LICENSING

Innovative models like Sponsored VASP allow easy market entry for new projects.

GOVERNMENT-

BACKED VISION

National strategies actively promote blockchain and digital asset adoption.

GLOBAL

ACCESS

Unlock access to 4 billion people around the world.

DISCUSS YOUR PROJECT WITH US

BOOK A CALL TO EXPLORE PRICING AND THE BEST-FIT PACKAGE FOR YOUR NEEDS.

EXPLORE MORE INSIGHTS

DISCOVER IN-DEPTH ARTICLES AND PRACTICAL GUIDANCE TAILORED FOR INNOVATORS IN WEB3 AND FINANCE.

Katerina Pyshko

Zainab Kamran

CONTACT US

TODAY

REACH OUT TO EXPLORE PRICING

AND THE BEST-FIT PACKAGE FOR YOUR NEEDS.